Paycheck calculator with dependents

Subtract any deductions and payroll taxes from the gross pay to get net pay. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Hourly To Salary What Is My Annual Income

Interest dividends retirement income etc.

. The IRS instructions are to include this credit only if your income is 200000 or less 400000 or less if married filing jointly. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Oregon Paycheck Calculator Calculate your take home pay after federal Oregon taxes Updated for 2022 tax year on Aug 02 2022.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. If you have a spouse that works or have two jobs you should only claim these credits with one employerpaycheck. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Dont want to calculate this by hand. IR-2018-217 Get Ready for Taxes. Claiming dependents might affect your pay as well.

Using a paycheck calculator like ours will help you see how your paycheck changes when you withhold more or less money. The more frequently you get paid the smaller each paycheck will be. This is typically 2000 for each of your of children under age 17 that are your dependents.

This number is the gross pay per pay period. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

It can also be used to help fill steps 3 and 4 of a W-4 form. The PaycheckCity salary calculator will do the calculating for you. There is state-level exemptions for all type of filers and dependents.

Now you can easily create a Form W-4 that reflects your planned tax withholding amount. Heres how the new tax law revised family tax credits. IR-2018-167 Taxpayers with children other dependents should check their withholding soon Tax Tips.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. Refer to Tax Foundation for more details. Number of other dependents.

Use Withholding Calculator to help get right amount for 2019. Other income not from jobs year. Dont want to calculate this by hand.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. Subtract any deductions and payroll taxes from the gross pay to get net pay. All exemptions are in the form of tax credits.

This number is the gross pay per pay period. 2021 2022 Paycheck and W-4 Check Calculator. The PaycheckCity salary calculator will do the calculating for you.

Naturally the frequency of your pay will also affect the size of your paycheck. IR-2019- 107 IRS continues campaign to encourage taxpayers to do a Paycheck Checkup.

Seven Common Character Types Character Types Story House Seventh

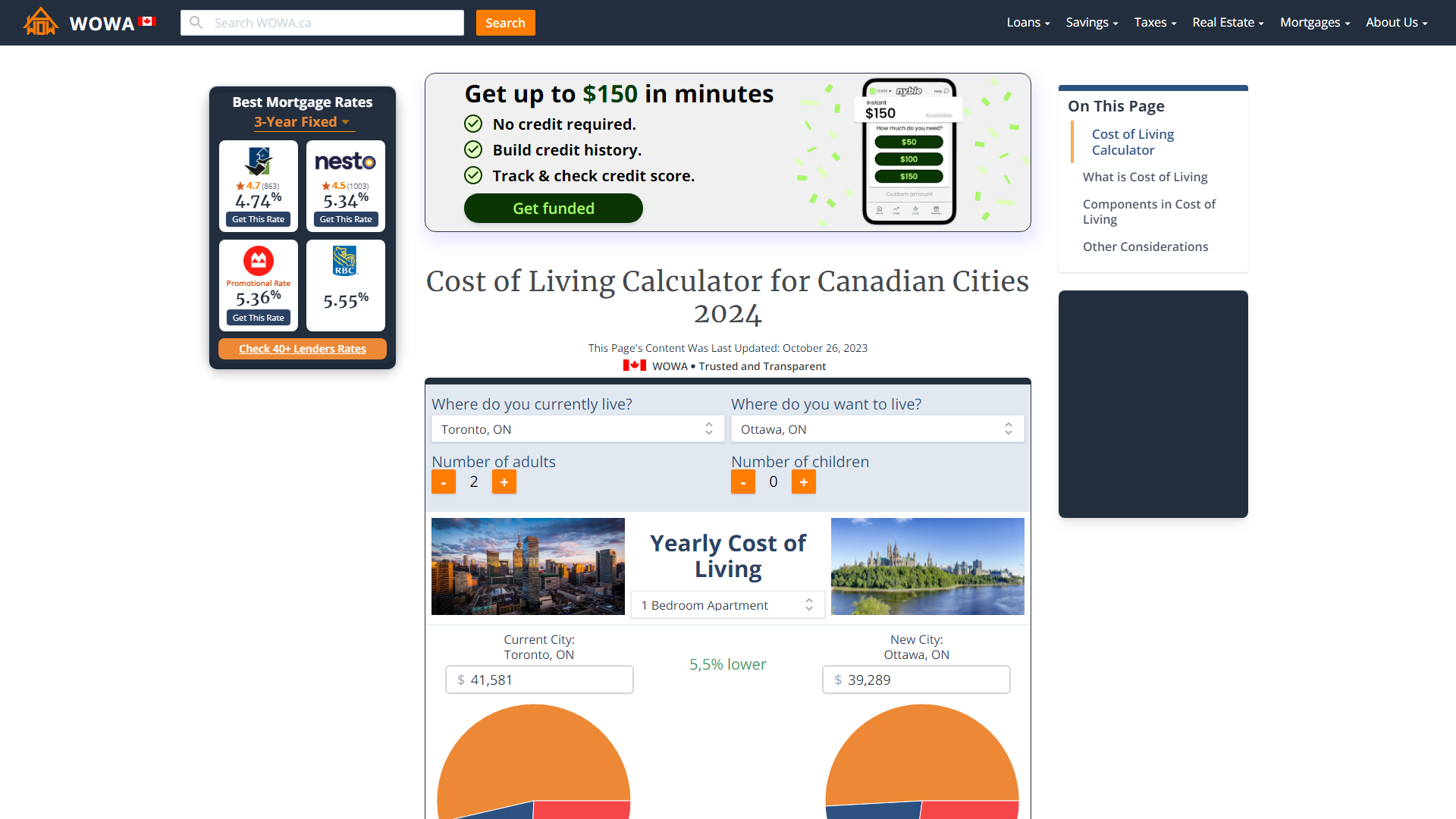

Cost Of Living Calculator For Canadian Cities 2022 Wowa Ca

Ontario Income Tax Calculator Wowa Ca

What Is Tax Debt How Can I Pay It Off Quickly

20d Mortgage Application Checklist Template Mortgage Application Checklist Template In Word Format Doc Mortgage Lenders Mortgage Tips Refinance Mortgage

Avanti Income Tax Calculator

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Net To Gross Calculator Online 58 Off Www Ingeniovirtual Com

Pin On Calculator

2021 2022 Income Tax Calculator Canada Wowa Ca

Excel Formula Income Tax Bracket Calculation Exceljet

2022 Salary Paycheck Calculator 2022 Hourly Wage To Yearly Salary Conversion Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

How To Calculate Payroll Taxes Methods Examples More

Do You Need To File Taxes Money Skills Filing Taxes Tax Preparation Services

Avanti Income Tax Calculator

Do This By Dec 31 To Get More College Aid From Fafsa Tax Preparation Fafsa Business Tax